Form 16 is a significant document in the Indian income tax system that holds great relevance for taxpayers. It is an essential document issued by employers to their employees, serving as proof of the taxes deducted from their salaries. Here are top points explaining the importance of Form 16 and its connection to the income tax slab:

- Form 16 is a certificate provided by employers to salaried individuals, summarising their income, tax deductions, and net taxable income.

- It acts as evidence of the tax deducted at source (TDS) by the employer on behalf of the employee.

- Form 16 serves as an important document during the filing of income tax returns (ITR).

- It helps employees understand the breakup of their salary components and deductions claimed under various sections of the Income Tax Act.

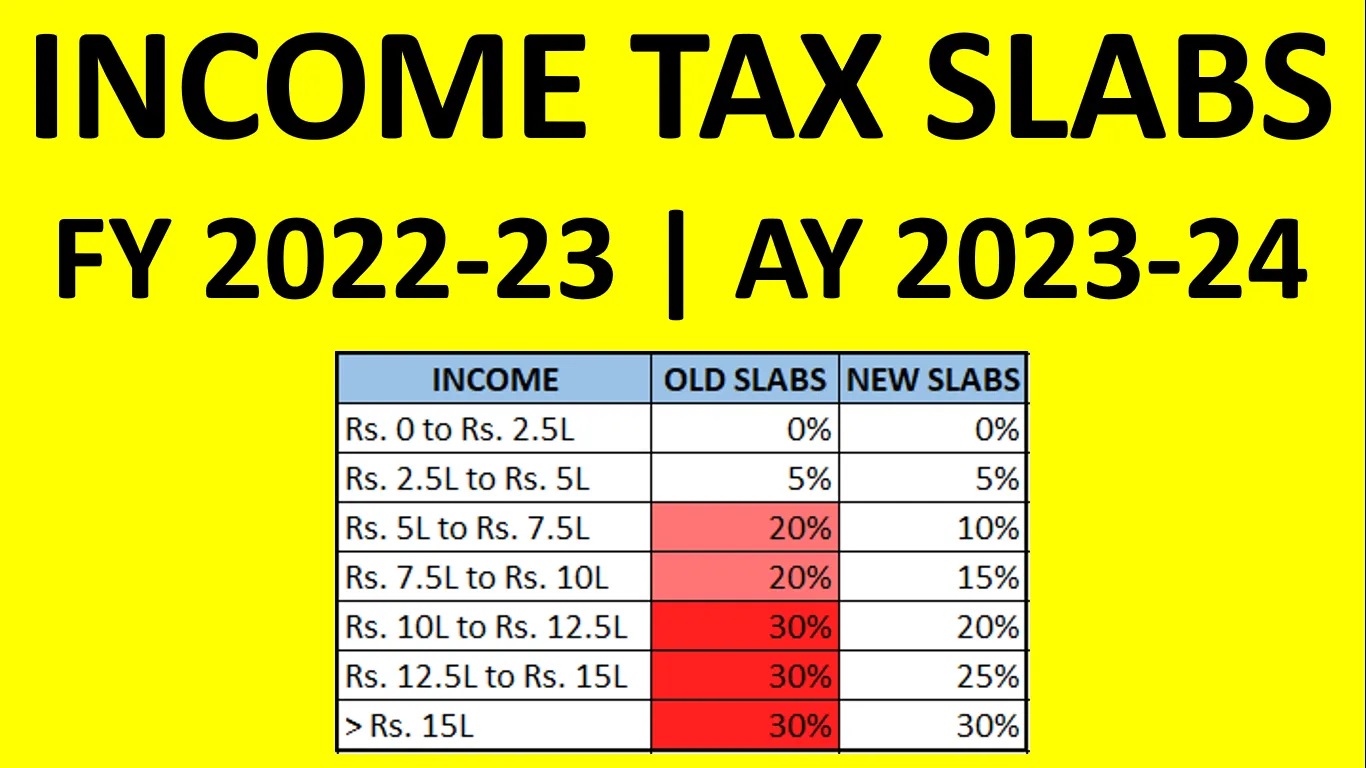

- The income tax slab refers to the different tax rates applicable to different income levels.

- Form 16 provides details about the employee’s gross salary, allowances, and perquisites, facilitating a better understanding of their taxable income.

- It includes information on the exemptions and deductions availed by the employee, such as House Rent Allowance (HRA), Leave Travel Allowance (LTA), and deductions under Section 80C.

- Form 16 assists employees in computing their total taxable income accurately.

- The income tax slab determines the tax liability based on the income earned during a financial year.

- Form 16 ensures transparency and accountability in the employer-employee tax relationship.

- It helps employees cross-verify the taxes deducted by their employers with their salary slips and payslips.

- The income tax slab provides a progressive tax structure, with higher tax rates for higher income brackets.

- Form 16 acts as proof of tax payment and can be used as a supporting document during any tax scrutiny or assessment by the Income Tax Department.

- It aids in the reconciliation of the tax deducted and deposited by the employer with the government.

- The income tax slab helps the government in generating revenue for the development of the nation.

- Form 16 is crucial for salaried individuals who are eligible for income tax refunds.

- It simplifies the process of filing income tax returns by providing all the necessary details required for accurate computation.

- The income tax slab ensures a fair distribution of the tax burden among different income groups.

- Form 16 is particularly relevant for salaried employees who do not have other sources of income.

- It assists employees in determining their tax liabilities and planning their finances accordingly.

- The income tax slab is periodically revised by the government to align with economic conditions and policy objectives.

- Form 16 serves as an official document that reflects the income earned and taxes paid, promoting financial transparency.

- It helps employees track their tax payments and facilitates compliance with the income tax laws of the country.

- The income tax slab provides tax-saving opportunities through various deductions and exemptions.

- Form 16 empowers employees with a comprehensive view of their tax deductions, ensuring they can claim eligible benefits and minimise their tax liability.

- Form 16 acts as a proof of employment and income for individuals applying for loans or credit cards, as it showcases their salary details and tax deductions.

- The income tax slab provides a structured framework for individuals to understand their tax obligations based on their income level, ensuring fairness and equity in the tax system.

- Form 16 enables employees to verify if their employer has correctly computed and deducted taxes according to the income tax slab rates.

- It assists individuals in availing tax benefits under different sections, such as Section 80D for health insurance premiums or Section 80G for donations.

- The income tax slab encourages individuals to invest in tax-saving instruments like Public Provident Fund (PPF), National Savings Certificates (NSC), and equity-linked savings schemes (ELSS).

- Form 16 simplifies the process of ITR filing for salaried individuals by providing consolidated information, reducing the chances of errors or discrepancies.

- It helps employees plan their tax-saving investments strategically to optimise their tax liabilities within the income tax slab framework.

- The income tax slab promotes progressive taxation, ensuring that individuals with higher incomes contribute a larger proportion of their earnings towards taxes.

- Form 16 assists in maintaining accurate tax records, which can be beneficial for individuals during loan applications, visa processing, or other financial transactions.

- It plays a crucial role in the assessment and audit procedures of the Income Tax Department, providing a comprehensive overview of an individual’s income and tax deductions.

- Form 16 serves as an important document for employees seeking employment in other organisations, as it provides a summary of their tax deductions and income details.

- The income tax slab ensures that individuals contribute their fair share of taxes based on their ability to pay, promoting social and economic equity.

- Form 16 helps individuals determine their eligibility for certain government schemes and benefits that are linked to income levels.

- It assists employees in assessing their tax liability accurately and avoiding any underpayment or overpayment of taxes.

- The income tax slab incentivises individuals to disclose their actual income and discourages tax evasion practices.

- Form 16 acts as a reliable document for individuals to reconcile their income and tax details with the Form 26AS, which reflects the tax credits available to them.

- It provides employees with a comprehensive understanding of the tax exemptions and deductions they can claim, allowing them to optimise their tax planning within the income tax slab.

- Form 16 serves as a proof of income for individuals applying for visas or immigration, as it provides a comprehensive overview of their earnings and tax deductions.

- The income tax slab facilitates tax planning for individuals by offering different tax rates for different income brackets, allowing them to make informed decisions regarding their investments and expenses.

- Form 16 enables employees to understand the impact of tax-saving investments and deductions on their net taxable income, helping them optimise their financial strategies within the income tax slab framework.

In conclusion, Form 16 plays a vital role in the income tax slab framework of India. It provides salaried individuals with a clear understanding of their taxable income and tax deductions, facilitating accurate tax filing and compliance with the country’s income tax laws. By comprehending Form 16 and the income tax slab, taxpayers can effectively manage their finances and fulfill their tax obligations.