Picture this: a world where banking is as easy as snapping a photo. With mobile check deposit, that world isn’t in some distant future; it’s the present. The horizon of banking is expanding, simplifying once tedious tasks into actions that can be performed from the comfort of one’s couch.

The Dawn of Digital Banking: From Branches to Smartphones

Gone are the days when banking meant dedicating precious time to visit a physical branch and stand in line for routine tasks. With the advent of digital banking, including the revolutionary mobile deposit feature, users can transact and manage their finances from the palm of their hand. It’s akin to shifting from traditional storytelling to virtual reality narratives—a transition that enhances engagement, immersion, and efficiency.

Decoding the Mobile Deposit Magic: How It Works

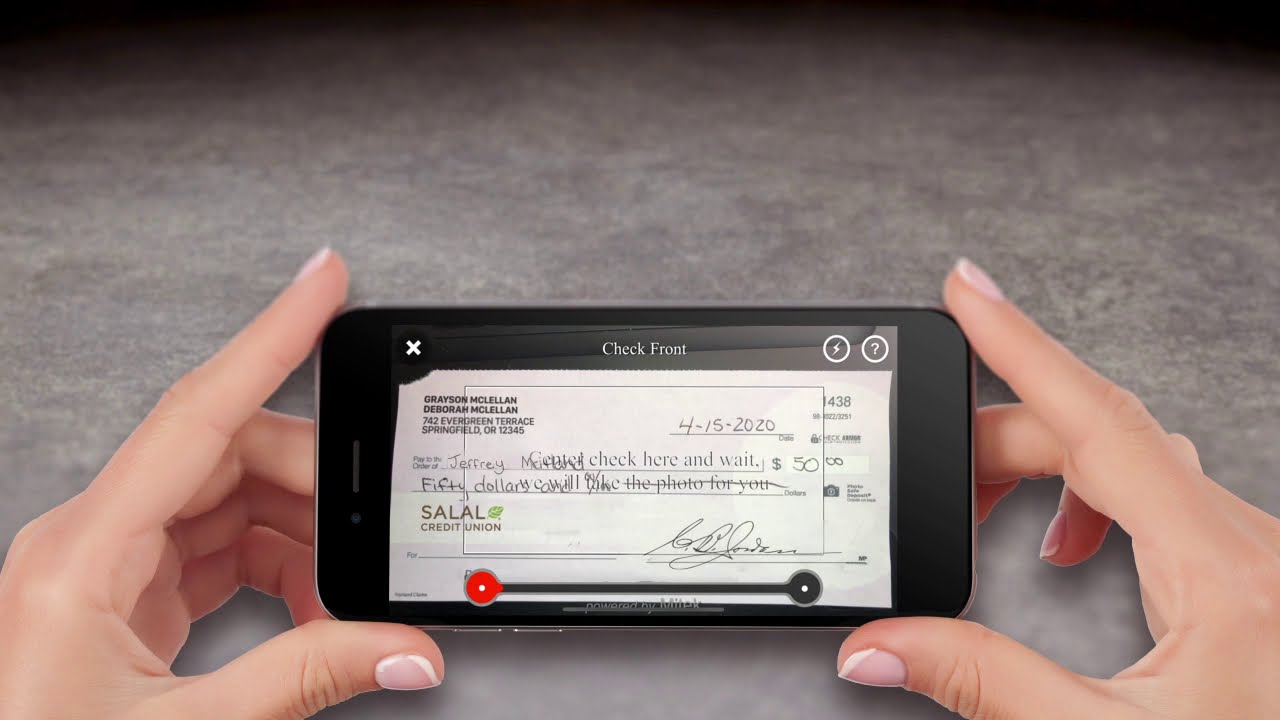

While the mobile deposit feature may seem like magic, it’s rooted in the power of technology and innovation. When a user deposits a check using this method, they essentially leverage their smartphone’s camera to capture high-quality images of the check. These images are then transmitted securely to the bank for processing, eliminating the need for physical transportation and expediting the entire deposit process. Think of it as a digital envoy swiftly delivering vital information to its destination.

Prioritizing Security in a Digital Landscape

In an age where cybersecurity is paramount, the mobile deposit feature strongly emphasizes safeguarding users’ sensitive information. Banking institutions deploy advanced encryption methods and multi-factor authentication to protect every transaction against potential threats. This robust security framework is akin to constructing an impregnable fortress, shielding users’ assets and personal data from unauthorized access.

A Step-by-Step Guide: Navigating the Mobile Check Deposit Process

- Preparation: Ensure you have a compatible smartphone and the official banking app downloaded and installed.

- Image Capture: Employ your smartphone’s camera to take clear and legible images of both sides of the check. Align the check within the provided guidelines for optimal image quality.

- Data Input: Enter the relevant details, such as the check amount, into the app’s designated fields. Double-check for accuracy to prevent any discrepancies.

- Submission: Once you’ve reviewed and confirmed the accuracy of the check images and information, submit the deposit request through the app.

- Confirmation: Await the confirmation message from the bank indicating that your deposit has been successfully received and processed.

Unlocking the Full Potential: Beyond Mobile Deposits

While the mobile deposit feature has undoubtedly revolutionized how one deposits checks, its impact extends beyond this single function. Modern banking apps offer a range of features, from real-time balance monitoring and fund transfers to bill payments and financial insights. This comprehensive suite of services transforms smartphones into virtual financial hubs, providing users unparalleled convenience and control over their financial well-being.

SoFi states, “With mobile deposit, you’re able to deposit funds into your SoFi bank account by simply taking photos of the front and back of the check. This means you never have to take your check to a physical bank and can make deposits from the comfort of your home.”

Anticipating Future Innovations: The Ever-Evolving Banking Landscape

As one looks ahead, it’s evident that the mobile deposit feature is just the tip of the iceberg in digital banking innovations. With the rapid evolution of technologies like artificial intelligence, blockchain, and biometrics, banking is poised for even more transformative changes. It’s akin to standing at the threshold of uncharted territories, ready to embrace the next wave of innovations that will further enhance how one manages, saves, and invests money.

The trajectory of banking’s evolution is awe-inspiring. What was once a task requiring physical presence and paper has been distilled into a few taps and swipes on a screen. As technology continues to weave its tapestry, one can only wait eagerly to see the next patterns it will create in the vast canvas of banking.