When winning the lottery in the US, the winners must pay these taxes including Federal taxes, State taxes, and Local taxes. However, some states, counties, and cities do not require taxes.

Do you want to win PowerBall Lottery? Let buy your Powerball tickets for the next lottery. Check out https://loto188.me to know lottery prediction algorithm to win.

What taxes do winners need to pay when they win the lottery in the US?

In 2019, the highest federal tax rate is 37% for total income in excess of US $510,300 for singles and the US $612,350 for married people filing a joint return.

Of which, 24% of the prize value has been withheld by PowerBall and Mega Millions to pay federal taxes, the winner only needs to pay the remaining amount or receive the balance if any.

Federal taxes are applied to the prize value after all deductions are taken out. State taxes and local taxes are two of those deductions. However, the Tax Cuts and Jobs Act limits the maximum deduction of each type to $10,000 in the tax years from 2018-2025.

The Balances will list the states that have the highest lottery income taxes and the states that make the most of lottery winners in 2018.

In particular, the areas that recorded the highest tax rates were Oregon (9.9%), Minnesota (9.85%), Iowa (8.98%), New Jersey (8.97%), Colombia and Vermont (8.95%).

However, New York City residents of Yonkers and New York are the highest taxpayers in the US when they win the lottery because of both state and local taxes. If adding 3.9% of local taxes to 8.8% of state taxes, the rate of lottery tax that winners in here will pay is 13%.

Thus, if the winner of $1 million, people have to pay 126,960 USD tax, much higher than the figure of 10,000 USD exempt from the federal tax calculation.

Fortunately, some states have higher income tax rates than Oregon, typically Hawaii (11%) but do not participate in Powerball, so residents here do not need to worry about the tax for the tournament. reward. But at the same time, some states that do not collect income taxes like Alaska or Nevada do not participate in this national lottery program.

Meanwhile, five states that do not set other income taxes are Florida, South Dakota, Texas, Washington and Wyoming, along with four states that apply a tax rate of 0% to lottery prizes including California, New Hampshire, Pennsylvania, and Tennessee. This is the paradise of those who believe in luck.

Differences in tax regulations led to similar cases where the players shared a $ 687.8 million prize from Powerball in 2018. While Robert Bailey in New York received only $ 125.4 million. Then Lerynne West earned $ 140.6 million, though both chose to receive the full lump sum instead of splitting it for 29 years (annuity).

Hit it big playing the mega millions lottery? You’re probably thinking about how you’ll spend all that sweet cash. But first, Uncle Sam is going to want his cut. The Internal Revenue Service considers lottery money as gambling winnings, which are taxed as ordinary income.

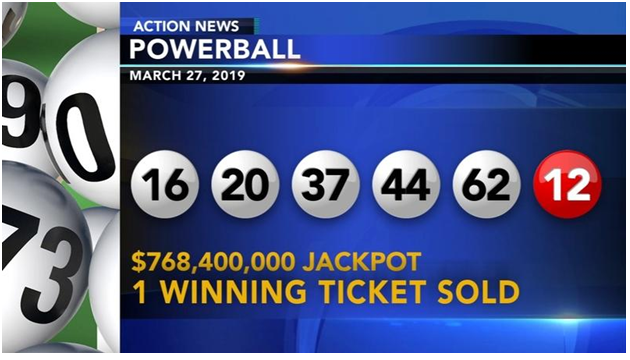

About Powerball jackpot

Powerball jackpot is the largest jackpot lottery in the world! Powerball is currently offering an unbelievable jackpot at $ 430 million. Do you want to win PowerBall Lottery? Let buy your Powerball tickets for the next lottery.

Information of Powerball

Powerball lottery is the largest American lottery game in the world sold by 45 lottery organizations in the form of sharing jackpot prizes. MUSL, a non-profit organization that has reached an agreement with lottery organizations, is the organizer of the Powerball. The minimum prize of the PowerBall lottery is 40 million USD and the prize can be accumulated up to billions of dollars.

American Powerball is held in the following states: Arizona, Arkansas, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Vermont, Virginia, Virgin Islands , Washington, Washington DC, West Virginia, Wisconsin US, USA. The high-tech studio of the Florida lottery in Tallahassee is where the draws are usually held. To promote the expansion of the game to a new range, a number of draws were held out of this venue.

In fact, Powerball is the first type of lottery to use two-drum. This means there are more tricks and more ways to win a jackpot, and there are many prize levels. Oregon Lottery’s Steve Caputo was the one who proposed the two-drum concept. Other games that use the two-drum concept are Mega Millions, Australia’s Powerball, UK’s Thunderball, and Euros Millions. Powerball lotteries were held at Screenscape Studios Iowa until 2008. Mike Pace, the local broadcaster, also held the draws. He has also held MUSL draws since the first US lottery in 1988. In 1996, the Powerball lottery aired for the first time. In addition PowerBall lottery also held five remote draws at the Summer Olympics in Atlanta.

Jackpot history of Powerball

The biggest jackpot in history took place in the draw on November 28, 2012. Jackpot type – Jackpot paid in 29 times per year (tax rate of 36.00%) or once (tax rate of about 50%). The Jackpot prize is 587,500,000 USD in annual accumulation or 384,700,000 USD in cash. Two tickets (from Missouri and Arizona) are eligible for this jackpot prize.

A Powerball record for the largest lottery prize on a return ticket on August 15, 2012. The Jackpot Prize is $ 337,000,000 in cumulative annual cash and $ 223,700,000 in cash. This ticket has been purchased in Michigan.

The Jackpot Powerball Prize on 13/1/2016 became the largest lottery prize in the history of the American lottery as well as the world. $ 1.5864 billion is the result accumulated through 19 consecutive lucky draws without winners (from November 7, 2015). During the draw on January 13, 2016, 3 lucky players from California, Florida and Tennessee became the owners of the Giant Jackpot.