Top IT companies in the nation are anticipated to give muted financial performance for the quarter of April–June, with margins arriving under stress on account of wage revision and rupee appreciation, as per industry analysts.

Indian tech giants will declare their fiscal outcomes this week, commencing with Tata Consultancy Services on July 13, 2017. Its minor peers, Wipro and Infosys are planned to declare their figures on July 20, 2017 and July 14, 2017, respectively, in that order. “We anticipate tier-1 IT firms to give muted development in a seasonally sturdy quarter owing to slower speed of large contract closures and shortage of much expected fiscal services kicker,” Kotak Institutional Equities said to the media in its report.

With Euro, Pound, and Japanese Yen intensifying in opposition to the U.S. Dollar on chronological basis, there might be cross-currency tailwinds with a probability rate of 0.4–0.9%. “On the other hand, margins will be under stress owing to wage hikes, visa expenses, and 3.9% Rupee appreciation in opposition to the U.S. Dollar,” said the report.

The report further added that the leading 5 players—Infosys, TCS, HCL Technologies Wipro, and Tech Mahindra—are anticipated to report 1–4.2% dollar income development in the quarter one of fiscal year 2017–2018. Industry experts think that the speed of development for these firms will be feebler than normal owing to shortage of pace in the fiscal services space, which is a huge donor to the revenues of the sector. Apart from this, the speed of fresh contract closures also appears to be low.

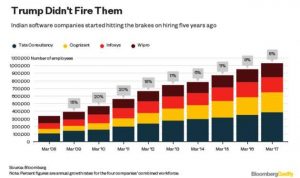

Indian IT industry is encountering problems in the business atmosphere and stricter work permit rules in nations such as the U.S., Australia, Singapore, and New Zealand. There have also been reports of huge cut offs by different firms, even though the sector has over and over again refused the accusations. Most of the companies have also postponed their salary hikes to later in the year, instead of the previous procedure of review from April itself.

The IT companies are also under stress to employ local employees as an alternative of taking Indian workers to client sites on work visas as the U.S. coagulates its stand on outsourcing. Higher on-site employment indicates higher prices. Infosys has claimed that it will employ 10,000 individuals in the U.S. over the coming 2 Years. Its peers, Wipro and TCS are also taking analogous steps.