Introduction to How2Invest Platform

How2Invest platform lets users to look for the most profitable strategies to finance in the correct stocks and companies. It aims to increase users’ access to affordable, educational, and convenient investment. Users may learn everything there is to precisely understand about investing and payments on this platform. Customers may also think about this platform, which serves as their comprehensive stock and range financial guide.

Investing in the genuine and correct stocks that will gain users credit without requiring any work on their part is the simpler method to generate some passive income with How2Invest. But rather than actually working at it, it all gets down to selecting the right buying and selling approach. And for this, users who are just starting out could need the insider knowledge to turn a profit.

Understand about ‘How2Invest’ in detail

How2Invest is an online course that offers crucial information on all aspects of investing, whether for beginners seeking guidance or professionals seeking advanced strategies. Unlike other complicated financial guides, the How2Invest Method breaks down complex investment theories into convenient steps.

Then, how is ‘How2Invest’ beneficial to users?

This is considered to be one-stop platform for anything related to investing. Whether users are new to the world of (DeFi) decentralized finance or they are an investing research nerd, How 2Invest has all the needs.

Users can track of their investments in just one place with How2Invest’s portfolio tracking tool. They can look for their investments without navigating across platforms in this manner. Instead, they can simply monitor everything from one location.

This program provides several components for tracking investments in several fields. They can quickly assess historical data, track the ups and downs of investments, and get a thorough picture of the performance of the portfolio as compared to other investors.

This is the Situation:

How2Invest users are advised to perform thorough study on the companies they want to invest in. Instead of trusting the rumors, everyone should conduct their own research since it is a reliable source of knowledge that is similar to trusting one’s gut. Let’s not forget that variation is like having a wide range of snacks for one’s assets. Users can withstand the storm and take advantage of several opportunities by distributing their personal investments across a range of ventures.

Traditional Investment v/s How2Invest

Some of the examples of traditional investment choices include gold, real estate, mutual funds, stocks, and bonds. Although these choices are still available to investors today, in the past they had to handle all of the research, decision-making, and investment through financial counsellors and investment businesses.

Investment results were eroded by the high fees that the advisors and businesses used to charge. Online investment applications with robo-advisors were created to address this problem. Investment landscapes are being altered by robo-advisors, and How2Invest is among them.

Those bonds, mutual funds, and equities can be purchased for as little as 0.25% account maintenance costs online. In addition, it provides portfolio management, tax-loss harvesting, and automatic rebalancing.

Investing wisely with How2Invest Platform

Users get access to a wealth of educational resources and investment best practices guidelines with this platform. To find out about other people’s investing experiences, users can read the instructions and articles. Furthermore, How2Invest will offer easily understood and actionable video guides.

The majority of the demonstration videos are accessible for premium members only. However, note that users might not receive enough VIP access or video content if they only pay once. However, this site does not offer any customized courses or recommendations depending on users’ financial situation.

The primary goal of How2Invest is to offer users profitable and legitimate financial advice, not to encourage stock trading or investments. This platform provides users with current information based on unbiased, knowledgeable financial data. Hence, it is entirely up to users how they understand the information of this platform.

Understanding the Different Types of Investments

1. Accounts Saving

Investing in savings accounts is a risk-free and secure method of trading and stock investing. In this one, the possibility of losing money is comparatively less. Users must put funds into their account to receive interest on this investment type. Users can still withdraw their money. However, users can only earn if they maintain a certain amount of credit for a predetermined amount of time.

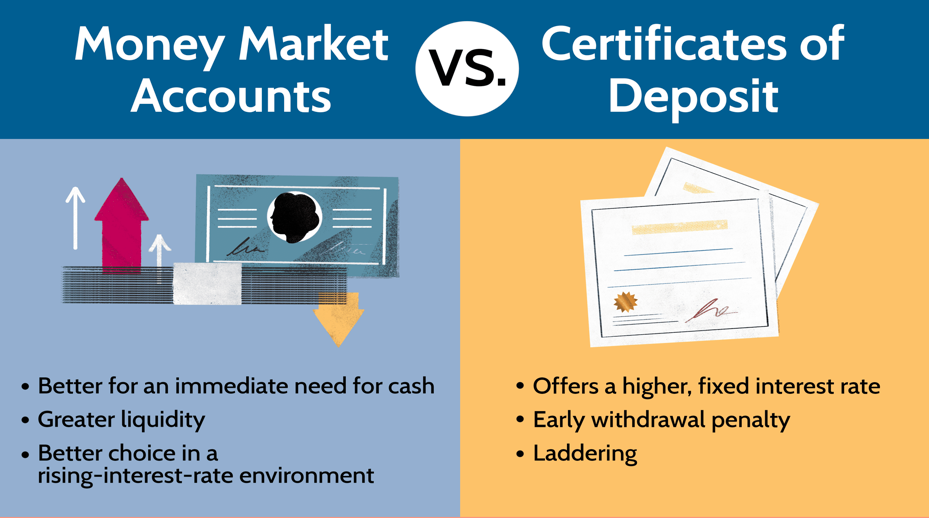

2. Money Market Accounts

This investing type, which also adheres to account-saving standards, is actually risky. Getting high interest rates is a significant benefit of investing in this type of securities. However, compared to certificate deposits investments, the withdrawal limits are more stringent.

3. Certification Deposits

CD investments, which function similarly to savings accounts, are another name for certification deposits. After a predetermined amount of time, users deposit money into their account and receive interest on that amount. But often, contracts for this investment type have a set term that can range from one to five years. Hence, the contract states that users are also not permitted to withdraw their money.

4. Treasury Bills

Investments in Treasury Bills are based on government-issued bills secured by short-term debt instruments. One month to a year is the period of maturity. Since the government supports these investments, there is always a guarantee that the money won’t be lost, making them safer.

Making more Progress with How2Invest Techniques

1) Maintain Diversity

Bring variations, but carefully! Invest in a variety of stocks, bonds, and properties. How2Invest provides the insider information needed to construct a profitable portfolio. Keep an open mind and stay informed. Using real-time data from How2Invest, users may adjust their plan in response to market fluctuations.

2) Focus on the Aim:

What are your nearest goals? Pay close attention to them. How2Invest can assist users whether their vision is to retire to a beachside home or to send their child to college.

Users are prepared to take on the investing world with these strategies in their toolkit and the power of How2Invest at their disposal.

3) Long-Term Goal:

Put off getting what you want right away. The secret to How2Invest is to gradually build a robust portfolio that will help get ready for the long run.

Practical: Bid farewell to shocking prices. How2Invest concentrates on maintaining low expenses to make investment accessible to everyone.

Important Things to know about How2Invest

1. Clearly Stated

There exist multiple drawbacks associated with How2Invest techniques. Even though it is excellent for direction, personalized counsel could be missing.

2. Technology-Driven

Unexpected progressed in the market could bring on hitches since it is automated.

3. Technical Problems:

Users can pass opportunities or lose their money in case the system crashes.

4. Human Element

Algorithms support everything; most of the times, operational insight could be missing.

The Final Lines

Considering all the things, How2Invest is a great option for anyone wishing to manage their money wisely. It has gained popularity among investors of all skill levels due to its affordable prices, easy-to-use interface, and wide range of investment alternatives.

Basic Error Easy is great, but remember the fundamentals—a working knowledge of financial markets is essential. Happy Investing!