To track the sum your employees get in tips each payroll period, you require to receive Form 4070 from them. This document empowers you to seamlessly cope with your Employer’s Quarterly Payroll Tax Return, so it’s crucial to fill it out correctly. Let’s delve into the topic dive by dive to ease the procedure.

What Is Form 4070?

Any employer is obliged to file a yearly W-2 form for each of the hired employees. It is impossible to do without a specialized IRS tip reporting Form 4070, which states each worker’s tip income. Though the earned tips are the property of every respective employee, you still have to report these numbers for tax purposes. Form 4070 is a convenient way for your employees to monitor their tips and report the data you need. Your workers don’t have to fill out any additional forms to report their tip income to you. However, they are to provide you with a signed statement with the essential information every month.

Who Can File Form 4070?

Any worker getting tips needs to keep a record of their share because the IRS will still ask you for tax reporting. Every month, they should provide you with the next information:

- their name, address, and SSN (Social Security Number);

- your business name and address;

- a specified period of the report;

- the total sum of tips earned throughout that time frame.

With this data properly provided in tax form 4070, you can maintain your business tax records accurately. It serves as an “Employee’s Monthly Record of Tips.” Since failing to report your employee tip income can result in fines or back-due taxes, you should educate your workers to prevent any unwillingness they might have regarding reporting all their tip income. They have to be aware of how to report tips on a tax return and that you report this data on their behalf to the government in Form W-2.

How to Fill Out Form 4070?

The form consists of two pages, the second of which has explanations of its purpose and details to guide your employee during the filling out procedure. They need to report any tips gained over $20 per month, and the form must be filed by the tenth day.

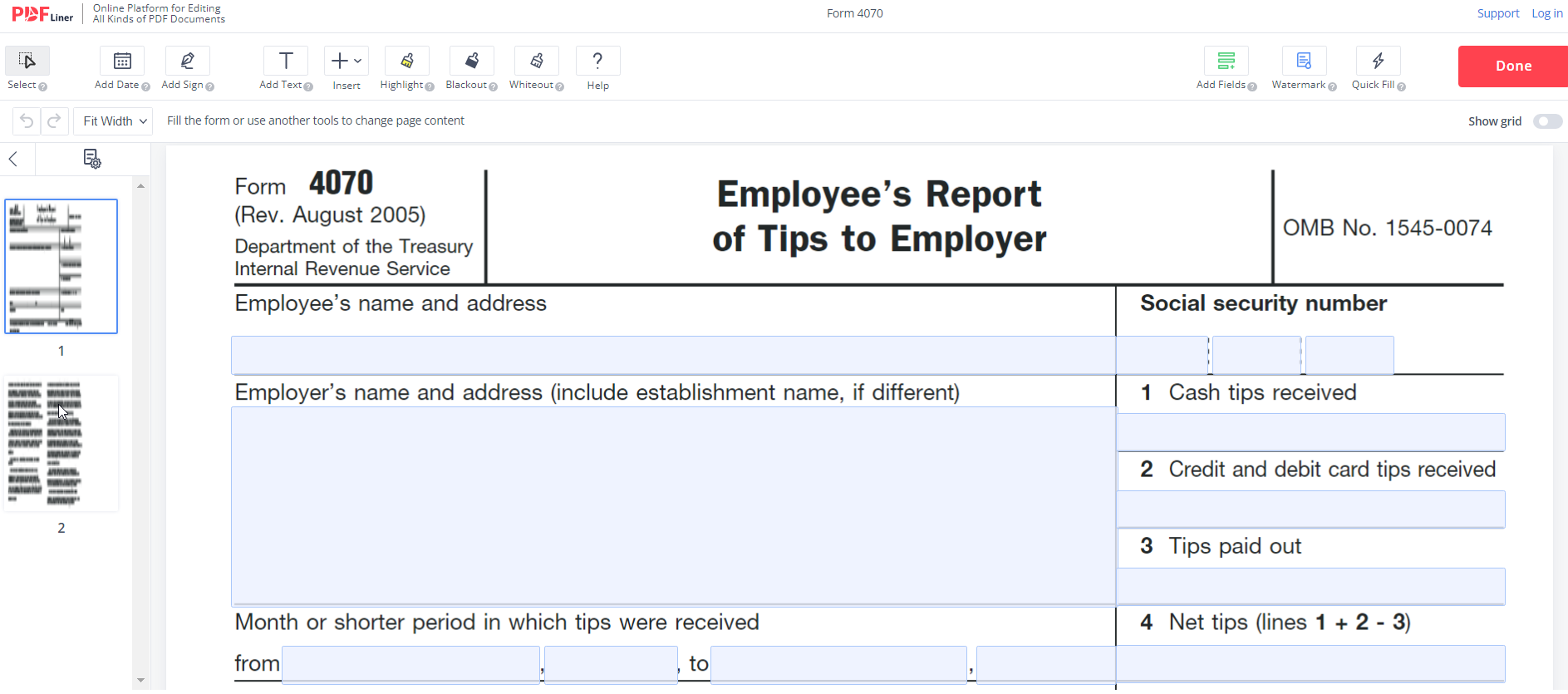

The structure of Form 4070 is straightforward, and this document can be filled out intuitively. To make the process even more transparent, let’s look at the main steps your workers have to complete:

- On the left side of the form, there is an empty field for your employee’s name and address. Ensure they provide this information correctly.

- Below, they should put your (employer’s) name and address. If it differs, they have to include your establishment name.

- Underneath, they should define the month or shorter period in which they received tips (there is a time frame “from… to”).

- On the right, a worker has to enter their SSN (Social Security Number).

- Then, they need to state the sum for tips received in cash, on their credit and debit cards, and tips paid out.

- An employee has to calculate net tips using the next formula: lines 1 + 2 – 3.

- That is it! They can date and sign Form 4070 to ensure the form is legal.

Other Relevant Forms

While Form 4070 is used on a monthly basis, there are also several additional forms required to be completed with it:

- a 4070A form serves to keep daily track of employees’ tips. Using it, you can calculate the tax sum you have to withhold from your workers;

- if your business belongs to the food or beverage industry and is located in the U.S., you might also be required to file an extra tax form. Use Form 8027 if tipping is customary in your establishment(s) and you have more than 10 employees on an average business day.

You have to be aware of your obligation to withhold federal income, Social Security, and Medicare taxes on your employee tip income. You may withhold these taxes either through the employee’s compensation or by applying another technique.

Accurate Tip Income Reporting With Form 4070

Postponing dealing with Form 4070 might cost you a lot of time at the end of the tax year. Use our comprehensive guidelines; keep yourself informed about how much your workers earn in tips, educate your employees on their tax reporting responsibilities, and maintain your records in order.

Based on article by pdfliner.com.

Author

Dmytro Serhiiev

Tax Consultant & Co-Owner at PDFLiner