Fixed deposits are a part of every Indian household. There have always been times when our parents and grandparents invested their money in FDs considering its low risk. With the lower risk and popularity, FDs remain the most used investment tool in the country. But in recent times, debt funds are gaining popularity among households. FDs or debt mutual funds are one of the debatable topics among low-risk investors. This blog distinguishes between debt funds and FDs

What are FDs?

Fixed deposits or FDs are financial instruments offered by banks and other financial institutions. FDs have a lock-in period and upon the completion of the period, investors can gain a return with decent interest rates. The assured return offered by the FDs is one of the important factors that a lot of investors choose to invest in FDs

What are Debt funds?

Debt funds are the close equivalent of FDs. They invest in low-risk instruments such as government bonds, corporate bonds, treasury bills, certificates of deposit, commercial paper, etc. Therefore, debt funds offer fixed returns to their investors with good interest rates. This is one of the important reasons investors choose debt funds.

Comparison between FDs and Debt funds

1. Capital protection:

FDs offer guaranteed returns as regulated by Deposit Insurance and Credit Guarantee Corporation, RBI. Moreover, all the investors in FD have been insured for a minimum of Rs.5 lakhs in case of bank failure. Therefore, your capital is very safe in FD investments.

In the case of debt funds, you do not have any insured amount. The capital invested in debt funds is subjected to market fluctuations and varying market trends. But the instruments invested in debt funds are at lower risk. But the debt funds are invested in lower-risk instruments like government bonds and corporate bonds . Therefore, there is not much risk involved in debt instruments.

2. Returns:

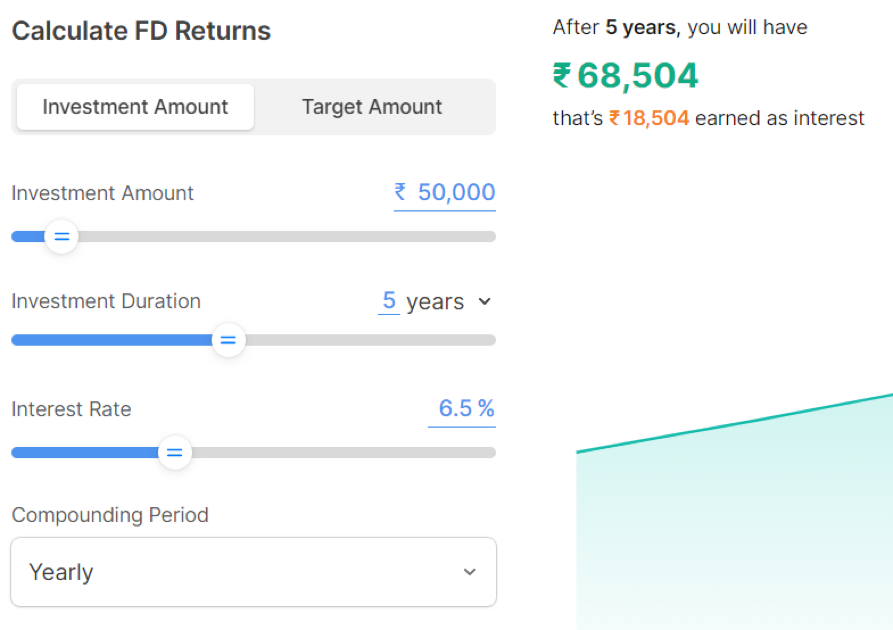

Returns in FDs are fixed. You are allowed to select the tenure of your investment and the associated return rate during the time you start your investment. For example, if you are choosing to invest Rs.1,00,000 every month for 3 years at a rate of 6.45% interest, you get a return of Rs. 1,24,750 at the end of 3 years. This return amount is fixed and you are guaranteed to get this at the end of your tenure.

In debt funds, the returns usually depend on the credit scores and other factors of the securities present in the debt fund. The returns are not guaranteed and are completely based on market fluctuations. On average debt funds offer higher returns than traditional FDs. Therefore, selecting a debt fund with expert advice can yield good returns.

3. Taxing of the returns:

Taxing of FDs is done both by the bank and in your income tax return. Tax at source is deducted annually during the time of interest credit by your bank. Additionally, you should add your FD returns to your income tax return, and you are taxed based on your tax slab. If the interest is above Rs. 40,000 annually, you should pay 10% in taxes

On the other hand, Debt funds are taxed based on the tenure of investment. Funds redeemed in less than 3 years are considered short-term funds and funds redeemed after 3 years are considered long-term funds. The capital gains from debt funds are taxed in your income tax return with indexation benefits.

4. Withdrawal:

FDs can be liquidated at the end of your maturity period. This does not incur any charges except the TDS deducted at the bank. However, if you want to make a premature withdrawal, you should pay a certain percentage to the bank. You can also avail of loans with your FD.

Debt funds, except for the fixed maturity plan, do not levy any exit load on the customers. You can redeem your debt funds at any time without any restrictions. Therefore, debt funds offer more liquidity and can be used in times of emergencies to meet your short-term goals.

5. Transparency:

FDs are safer instruments of investment. But one cannot rule out the uncertainties such as bank mandates, RBI guidelines, NPAs, etc. Therefore, the FDs are considered less transparent. Whereas, debt funds, are more transparent. They maintain a record and portfolio to monitor the performance of the fund and you are duly informed in case of any changes.

Summing up:

In conclusion, both FDs and debt funds have their own pros and cons. It is up to the investors in deciding the investment instruments. Not all investors will have the same goals, risk appetite, and cash flow. Therefore, it is better to clearly explain your goals before starting your investment journey. Going through a new journey of investments can be intimidating. Don’t hesitate to contact investment coaches and experts before investing.