Ever wondered how scalping and day trading differ? Both are popular strategies in the fast-paced world of stock trading, but they cater to different types of traders. Scalping involves making quick, small profits, while day trading focuses on capturing larger price movements within a day. Let’s dive into these intriguing strategies to understand their unique characteristics and discover which might suit you best. Looking for the best markets for scalping? Visit https://atlasquantum.com/ to connect with educational experts and learn about scalping and investing.

Forex Market: A Haven for Scalpers

The forex market is a goldmine for scalpers. It’s known for its high liquidity, which means you can buy or sell large amounts of currency without much impact on the market price.

Major currency pairs like EUR/USD and GBP/USD often have very tight spreads. This is crucial because tight spreads mean lower costs for each trade, allowing scalpers to make the most of their small price movements.

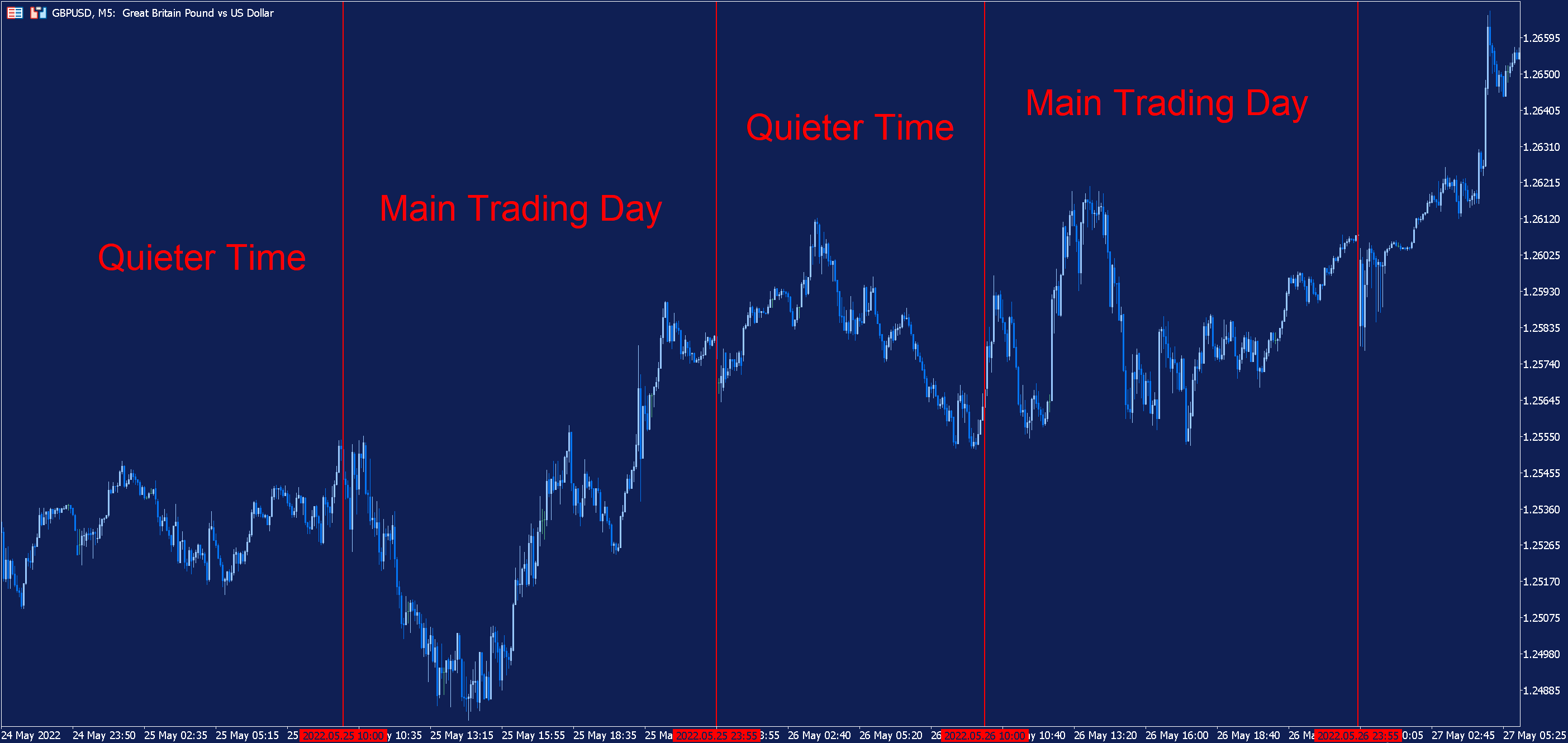

Scalping in forex isn’t just about the spreads, though. Timing plays a huge role. The most active trading sessions are the London and New York sessions. During these times, there’s a lot of trading volume and volatility, offering plenty of opportunities for quick trades.

For example, the London session overlaps with the New York session for a few hours, creating a particularly busy and potentially profitable time for scalpers.

Another aspect of forex scalping is the strategies used. Some traders rely on technical analysis, using charts and indicators to predict price movements. Others might focus on news events, taking advantage of the market’s reaction to economic announcements. Whatever the strategy, the goal remains the same: to make quick profits from small price changes.

Equity Markets: Opportunities in Stock Scalping

Stock scalping involves trading shares of companies. The equity markets offer a wide range of opportunities for scalpers, especially with high-volume stocks. Stocks of major companies like Apple, Google, and Microsoft often see a lot of trading activity, making them ideal for scalping.

When scalping stocks, it’s important to pay attention to the bid-ask spread. Stocks with tight spreads are preferable because they reduce the cost of entering and exiting trades. Additionally, using level II quotes can give you a better view of market depth, helping you make more informed decisions.

Scalpers in the equity markets often use tools like time and sales data, which show real-time transactions. This data can help identify patterns and trends that aren’t immediately obvious on price charts. For instance, if you notice a lot of buying activity at a certain price level, it might indicate support, making it a good point to enter a trade.

Futures Markets: Leveraging Short-Term Contracts for Scalping

The futures market is another popular arena for scalpers. Futures contracts, like the E-mini S&P 500 or crude oil futures, offer high liquidity and leverage. This means you can control a large position with a relatively small amount of capital, amplifying potential profits from small price movements.

Scalping futures requires a solid understanding of the market you’re trading in. Each futures contract has its own characteristics and trading hours. For example, crude oil futures are heavily influenced by geopolitical events and economic data. By staying informed about these factors, scalpers can anticipate market moves and act quickly.

Another benefit of futures markets is the availability of electronic trading platforms, which provide fast execution and a wealth of data. These platforms often come with advanced charting tools and indicators that are essential for scalping. Some scalpers even use automated trading systems to execute trades based on predefined criteria, taking advantage of the speed and efficiency of technology.

Cryptocurrency Markets: Navigating the Digital Frontier

Cryptocurrencies have taken the financial world by storm, and their high volatility makes them a prime target for scalpers. Bitcoin, Ethereum, and other digital currencies often experience significant price swings within short periods, creating numerous opportunities for quick trades.

One of the advantages of scalping cryptocurrencies is the market’s 24/7 availability. Unlike traditional markets that close on weekends and holidays, crypto markets are always open. This constant activity can be both a blessing and a curse, as it offers endless opportunities but also requires constant vigilance.

To succeed in crypto scalping, it’s essential to stay on top of news and developments in the blockchain space. Events like regulatory announcements, technological advancements, and market sentiment shifts can have a profound impact on prices. For instance, a favorable regulation announcement in a major economy can drive up the price of a cryptocurrency, providing a good entry point for scalpers.

Using technical analysis is also common in crypto scalping. Indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can help identify trends and potential reversal points. However, given the highly volatile nature of cryptocurrencies, it’s crucial to use these tools in conjunction with strong risk management practices.

Conclusion

Choosing between scalping and day trading hinges on your trading style and risk tolerance. Scalping suits those who thrive on rapid decisions and small gains, while day trading appeals to those who prefer larger, calculated moves. Understanding the nuances of each can help you navigate the stock market more effectively. Ready to find your trading groove? Explore both strategies and see which one fits you!