MACD is a momentum indicator that tracks the strength of price movements and changes in their trend direction. Traders use it to identify buy and sell opportunities within the market, as well as to determine whether an asset’s price is moving in the right direction.

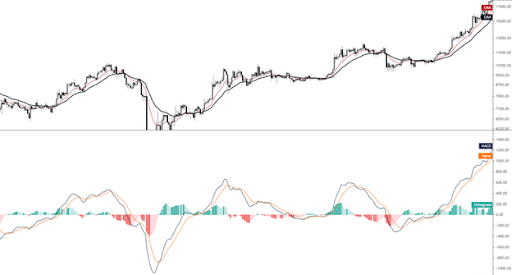

It uses a simple two-line exponential moving average (EMA) to measure price movement. One line is the main MACD line, which traces the long-term trend, and the other is the signal line, which marks the short-term trend.

When the MACD Crypto line crosses above or below the signal line, it gives a buy or sell signal. A bullish MACD crossover is a sign that the price may be in an uptrend, while a bearish MACD crossover indicates that the asset is in a downtrend.

Crossovers are a powerful trading tool, but they can also be misleading in some markets. As such, they should be used with caution.

The standard MACD strategy involves buying a position when the MACD rises above the signal line, and selling a short position when it falls below the signal line. Often, this is the most reliable strategy when price action confirms the MACD signal.

However, this approach can become lagging in weaker market trends, as the price can reach a reversal point before the MACD signal is valid. This is why it’s important to consider a different strategy when deciding to trade with MACD.

Another strategy is to use a zero-cross, which uses either of the MACD EMAs crossing the zero line to give a buy or sell signal. This strategy tends to produce fewer signals, but it also has less reversal risk than the standard MACD crossover.

A bearish MACD crossover is a signal that the price of a crypto asset is in a downtrend. Usually, this occurs when the MACD line rises above the signal line while the price of the crypto asset is making lower lows.

This can be an indication of a strong bearish trend, which could mean that the price is in a long-term downtrend or is about to break down. It can also be a sign of a bullish trend, which could mean that the price of the crypto asset is about to break out of a downtrend or is about to enter a new uptrend.

It’s also worth noting that MACD can be used with a number of different settings, which can help you obtain better analysis. For example, more sensitive and faster MACDs can provide traders with more signals, but they may also cause false trading signals.

MACD can be a valuable tool in trading cryptocurrencies, but it should be used carefully and with care. This is especially true when attempting to trade in volatile markets or during ranging trends.