Every business, whether for profit or not, is required to keep a record of its financial business transactions in the form of accounting books for the benefit of interested parties ( investors, owners, government departments, and so on). Accounting’s golden rules provide standardized regulations for the accountant to record all financial business transactions in order to prepare the accounting books. As a result, it is critical to learn them.

What Are The Golden Rules Of Accounting?

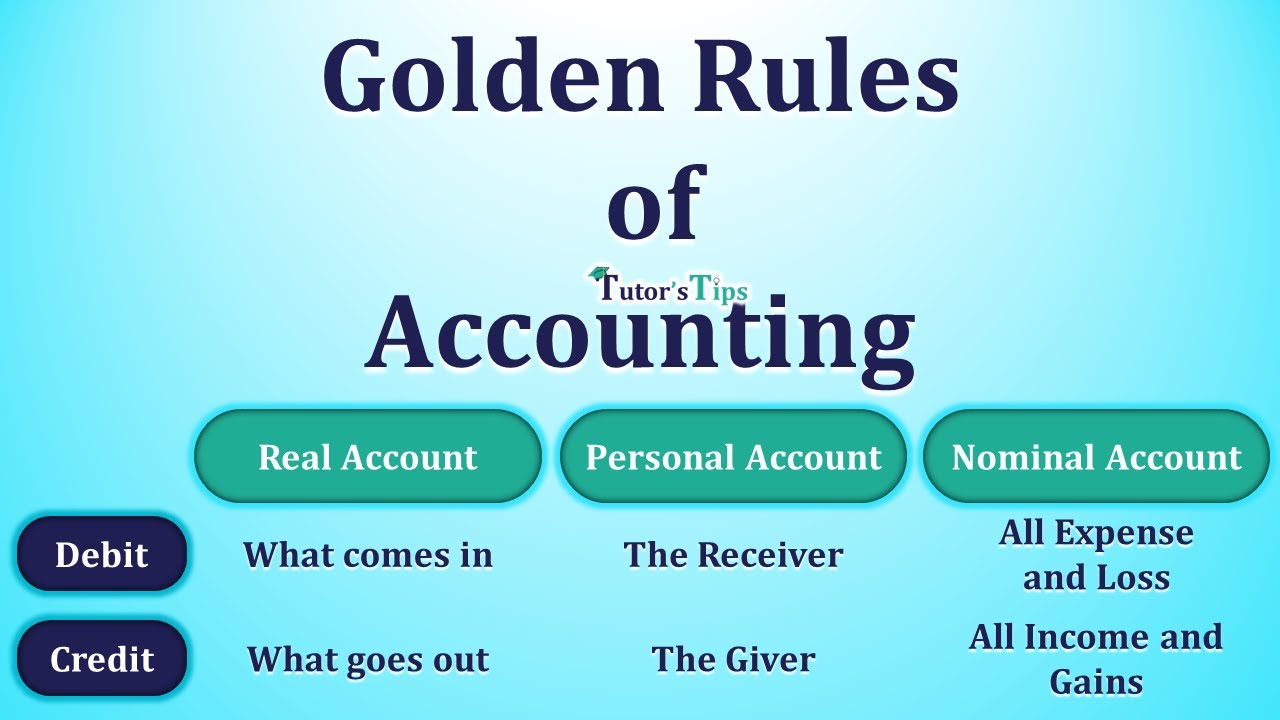

The golden rules of accounting form the foundation for recording all day-to-day financial business transactions in the Journal Book. These rules require a minimum of two accounts to be generated from a single business transaction. One is debit, and the other is credit, both of which are required for the journal entry to be recorded in the journal daybook. As a result, you can consider these rules to be the foundation of the Double-entry system. To understand the Golden Rules of Accounts, we must first understand the types of accounts as defined by the Golden Rules of Accounts, because the rules are applied to transactions based on the type of accounts included in the transaction.

These rules are also known as traditional rules of accounting or traditional approaches to accounting. Modern accounting rules or modern approaches to accounting have also been invented, with five types of rules, which we will explain in the following article.

Three Golden Rules Of Accounting Are As Follows-

- Debit what comes in and Credit what goes out which is applied to all the Real accounts.

- Debit the receiver and credit the giver this rule is applied to a Personal account.

- Debit all expenses & losses and Credit all income & gains, this rule is applied to all Nominal Account.

Types Of Accounts As Per The Golden Rules Of Accounting

The two most important aspects of accounting are debit and credit. To fully understand the rules of debit and credit, one must first understand the various types of accounting accounts. There are three types of accounts in accounting: real accounts, personal accounts, and nominal accounts, and the debit and credit rules that apply to these accounts are known as the Three Golden Rules of Accounting.

The golden rules of accounting are applied to all ledger accounts involved in business transactions, such as assets, liabilities, income, gains, expenses, and losses. As a result, ledger accounts are classified into three types according to the golden rules of accounting. These are illustrated by the following examples: –

- Real Account

Real accounts, according to the golden rules of accounting, are those accounts that are related to the assets of the business enterprise. As a result, this rule applies to the following business transactions involving asset accounts: –

- Purchase/Creation of assets,

- Dispose of an asset,

- Sale of assets,

- Assets are subject to depreciation.

To apply this rule, we must first understand what assets are.

Some examples of assets to which the Real Account can be applied are as follows:

- Fixtures and furniture;

- Cash;

- Land and buildings;

- Plant and Machines;

- Vehicles;

- Trademarks;

- Copyright

The list is lengthy. After completing this entire tutorial, you will be familiar with all of them.

- Personal Account

Personal accounts, according to the golden rules of accounting, include accounts pertaining to all types of people, namely natural persons, artificial persons, and representative persons. The three types of people are explained below: –

- Natural Persons: – The accounts which are related to human beings are known as natural persons. For example Shruti Pandey, Sanjay Thakur, Sachin, Shubham, Sonam Chauhan, etc.

- Artificial persons: – The accounts which do not have any physical existence and created by-laws are known as Artificial persons. For example, any business account may be a company, a firm, a bank, or an institution.

- Representative persons: – Those accounts which represent a person or a group of persons are known as representative persons. For example, Pre-received income, outstanding salary, accrued income, prepaid expenses, etc.

- Nominal Account

As per the golden rules of accounting, nominal accounts include those accounts that are related to all expenses/losses and incomes/gains.

The following are examples of all accounts to which the Nominal Account applies:

Expense Accounts: –

- Salary;

- Electricity bill;

- Wages;

- Telephone and mobile rent;

- Purchases;

- Transportation charges;

- Rent Paid, etc.

Income Accounts: –

- Sales;

- Rent on sublet building received;

- Commission received, etc.

Loss Accounts: –

- Loss by an accident;

- Loss on sale of an asset;

- Loss by fire;

- Loss by theft, etc.

Profit Accounts: –

- Profit on sale of an asset, etc.

Let’s Break Down The Golden Rules Of Accounting With Some Real-World Examples.

- Mahadev began his business with a capital of Rs. 100,000.

| Account types | Particular | Debit | Credit |

| Real A/c | Cash A/c _ _ _ _ | 100,000 | |

| Personal A/c | To Capital A/c | 100,000 |

In this question, Cash is a real account and Capital is a Personal account. The Golden Rules apply as shown in the table.

- Sold Goods to Mr. Namdev for cash Rs. 10,000

| Account types | Particular | Debit | Credit |

| Real A/c | Cash A/c _ _ _ _ | 10,000 | |

| Nominal A/c | To Sales A/c | 10,000 |

In this question, Cash is a Real Account and Sales is a Nominal Account. The Golden Rules apply as shown in the table.

- Paid to Sumiran Pvt. Ltd. Company Rs. 50,000

| Account types | Particular | Debit | Credit |

| Personal A/c | Sumiran Pvt. Ltd. A/c _ _ _ _ | 50,000 | |

| Real A/c | To Cash/ Bank A/c | 50,000 |

In this question, Sumiran Pvt. Ltd. Company is a personal Account and Cash/Bank is a Real Account. The Golden Rules apply as shown in the table.

- Paid to the Manager, Salary Rs. 60,000

| Account types | Particular | Debit | Credit |

| Nominal A/c | Salary A/c _ _ _ _ | 60,000 | |

| Real A/c | To Cash A/c | 60,000 |

In this question, Salary is a Nominal Account and Cash is a Real Account, The Golden Rules apply as shown in the table.

Conclusion :

The journal entries must be passed in accordance with the accounting Golden Rules, which will be summarised into a ledger account. The following are the golden accounting rules for carrying out the transaction:

- Debit the Receiver, Credit the giver.

- Debit what comes in, Credit what goes out.

- Debit all expenses and losses, Credit all income and gains.

These are the Golden Rules of Accounting because they form the foundation of accounting.

Hopefully, this post has been of assistance to you. If you have any questions or comments about the above article, please leave them in the comment section below. We will be happy to help you.