Since the inception of the fintech industry in India, it has faced many challenges. There have been many instances when its development was resisted. Innovations in this sector were met with regulatory uncertainties. This was primarily due to the conservative approach of the government. In addition to it, even most of the financial institutions in the country were previously guilty of encouraging slow and steady growth as opposed to supporting disruptive influencers like the fintech sector.

Fortunately, in the last two to three years, there has been a paradigm shift in almost all of these perspectives. There is a variety of reasons for this change in attitude. The regulatory authorities identifying the benefits of technology and its potential to bring transparency in the financial systems being one of the major ones. Moreover, the institutions also realised that better mobile connectivity and data analytics also allows existing financial institutions and regulators to create a much stronger and profitable proposition for their customers, which invariably will help improve their top and bottom line of growth.

Regulatory Barriers in BFSI Sector

In the past, extensive regulations have acted as a major hurdle for the new companies to make an entry in the Banking Financial Services and Insurance (BFSI) sector. Of late the more significant issue seems to be related to complications created by KYC and AML protocols and also data storage and digital identity. These have a critical impact on fintech entities as they slow down the adoption of the latest technologies. However, the change in the government’s attitude gives a lot of hope to the growing companies of the sector as they would expect more clarity in the upcoming regulations. The lack of experience of the Indian regulatory environment is reflected in the fact that it has quickly moved from a situation of excessive regulations hampering growth to the present scenario where the young fintech companies are getting affected by lack of regulations. There is a need for improvement in this regard to propel innovation and adoption of emerging technologies.

Changing Times in the FinTech Landscape

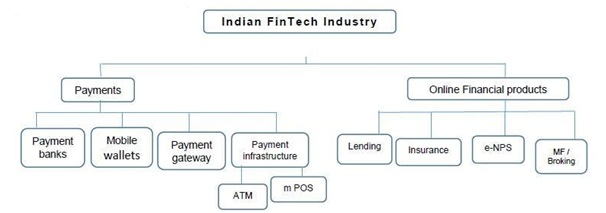

Strong and proactive policies of the government have resulted in increased opportunities in the fintech sector. Policies aimed to, boost financial inclusion, improve digitisation, increase knowledge of mutual funds, transaction cost is significantly reducedshare market etc. and aid MSMEs to grow, have perhaps inadvertently helped build a reliable platform for the fintech companies in India. The following are some of the policies which have had an impact in the fintech sector in India:

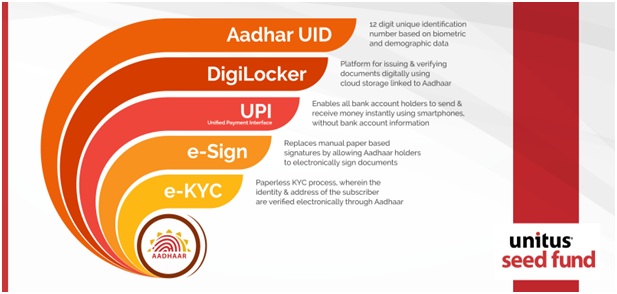

- India Stack: The introduction of India stack has enabled many of the fintech companies to accelerate their growth. With its debut, the Government of India has given all the innovators, entrepreneurs and corporations of the nation a world-class technological framework. This is a situation which resembles the policy support of the 1990’s provided to the telecom industry. This time the focus is on Fin-tech.

- UIDAI and Aadhar: The implementation of Aadhar based bio-metric authentication that helps in opening of bank accounts with e-KYC at any of the Banking Correspondence locations has aided many fintech firms. This is beneficial to the industry as it allows e-KYC checks to be done in a more economical manner, which helps attract customers as transaction cost is significantly reduced.

- Jan Dhan Yojana: The world’s biggest financial inclusion program which facilitates the creation of bank accounts for an unserved and underserved section of the Indian population has come about as a major breakthrough. This has for the first time in the history of India aimed to develop banking habit among the rural population.

- Initiatives by National Payments Council of India (NPCI): The Unified Payments Interface introduced by NPCI has leveraged the increasing presence of the mobile phones as acquiring devices to substantially reduce the required investment on infrastructure for the fintech companies. With the mobile user base set to increase rapidly in the next few years and projects like Digital India reaching its fulfilment, the future looks bright for this sector. In addition to this, NPCI’s introduction of innovative products like RuPay provides an ideal platform for the fintech firms to introduce and popularise the new technologies into mainstream banking in India.

The policies mentioned above have given a lot of encouragement to the fintech sector. The changes initiated will also in all likelihood increase investment in the industry. Moreover, the growth and the development of these companies will ensure speedy and effortless banking experience for the general people of the country, in a sector which is still lagging behind in terms of innovation.